Free Download Stock And Options Strategy: Volatility Surf Trade (low risk) by My Options Edge

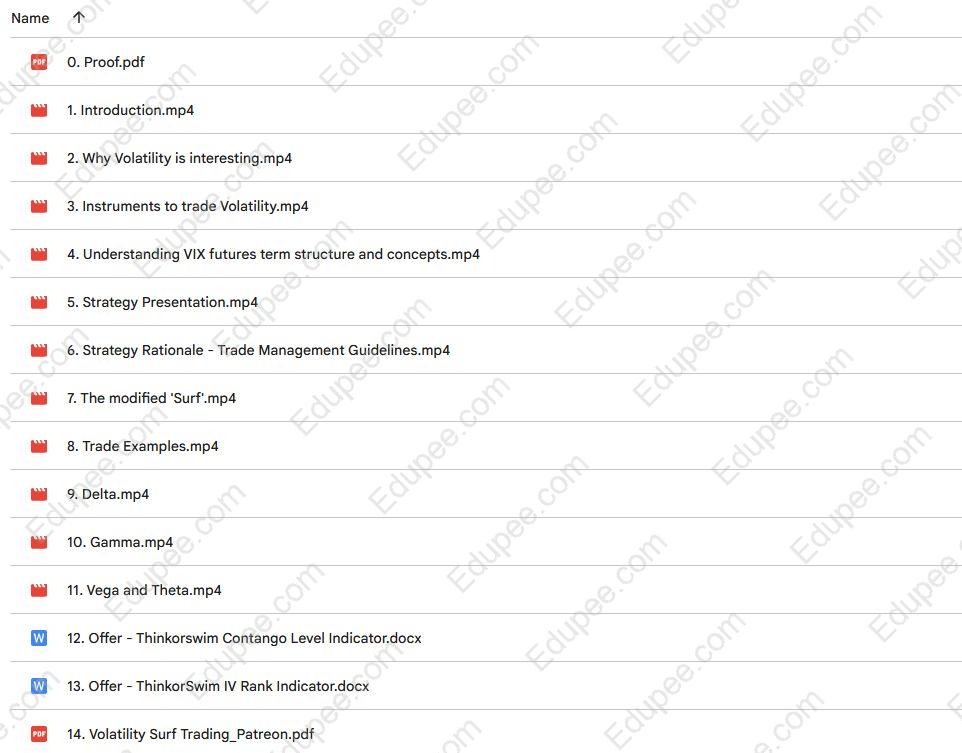

Content Proof:

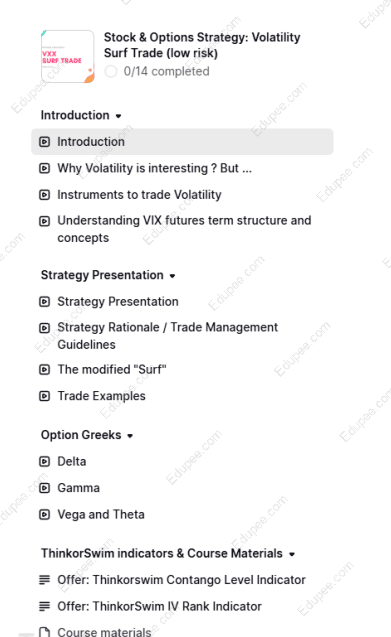

Stock & Options Strategy: Volatility Surf Trade (low risk)

An easy to apply and highly profitable stock and options trading strategy using Volatility ETNs (VXX or UVXY).

Course description

Note: I am actively trading this strategy and sharing it for Full Memberships access!

You should join this course if you:

-

… have already taken an options course but found it too theoretical and lacking a clear, proven strategy.

-

… know the basics of options but need a practical framework to apply them in real markets.

-

… struggle with consistency when trading stocks, forex, or derivatives.

-

… haven’t been profitable using stock scalping or swing trading approaches.

-

… rely on technical analysis but don’t see positive results.

-

… use trading indicators that fail to generate profitable signals.

-

… tried shorting volatility and suffered major drawdowns during volatility spikes.

-

… want to follow a structured trading plan with clear, mechanical entry and exit rules.

This program will walk you through a strategy that blends stocks with options to capture profits from the unique price behavior of Volatility ETNs such as VXX and UVXY. These products tend to decline over time, and the strategy aims to benefit from that long-term erosion caused by contango and roll yield.

The instructor specializes in volatility-based strategies using options (and now stock + options together). Having moved away from trading individual stocks, stock options, and forex years ago, the focus now is entirely on volatility as an asset class. This expertise has also been published in a book on Amazon titled The Volatility Trading Plan.

In this course, you will learn a combined stock and options based trading strategy (entry-level, very easy to implement) that will give you capital appreciation with protection benefiting from stock options! It is a proven stock options strategy, with a market edge, that will boost your portfolio returns!

This course starts with the volatility analysis fundamentals (VIX Futures Curve analysis and concepts) and then moves to the development of this combined stock options trading strategy, including its rationale. Additionally, I will provide an updated version (higher risk strategy) of it that will benefit from sudden increases in volatility. Both strategies have clear entry and exit rules that can be applied on mechanical trading.

After this course, you will have access to a very consistent and highly profitable stock and options combined strategy!

This options course describes a full investment methodology with a detailed explanation of its rationale and expected outcome. It includes details on some backtests developed to support its robustness and consistency as well as alternative tests presented to support the chosen criteria.

This options trading methodology should be a very good add-on to increase the return of your Stock or ETF portfolio! If you are trying to scalp stocks or using stock options on your trading and not achieving results, move to this asset class – Volatility! Also, you do not need to have any knowledge of technical analysis or even indicators. Just follow the clear strategy instructions given market outputs.

Options are derivatives and could be stock options that have stock as their base asset. In this case, we trade a derivative, which is volatility! We are trading derivatives of a derivative!

Only basic options knowledge is needed as well as a brokerage account (either live or practice account if you want to test it first)!

Course content:

My Background / Experience

Why Volatility investing is much more interesting

Volatility trading risks (and how to control them)

Instruments of Volatility Trading

VIX® futures Term Structure

Contango, Backwardation and Roll Yield

Strategy rationale

Trading Rules (Basic Surf Volatility Trade)

“Modified Surf ” trading rules

Trade Examples

Free video Sample from Stock And Options Strategy: Volatility Surf Trade (low risk) by My Options Edge

Contents

Introduction

- Introduction

- Why Volatility is interesting ? But …

- Instruments to trade Volatility

- Understanding VIX futures term structure and concepts

Strategy Presentation

- Strategy Presentation

- Strategy Rationale / Trade Management Guidelines

- The modified “Surf”

- Trade Examples

Option Greeks

- Delta

- Gamma

- Vega and Theta

ThinkorSwim indicators & Course Materials

- Offer: Thinkorswim Contango Level Indicator

- Offer: ThinkorSwim IV Rank Indicator

- Course materials

Reviews

There are no reviews yet.