Free Download Stock Options Strategy: VXX Short Vertical (mid/high risk) by My Options Edge

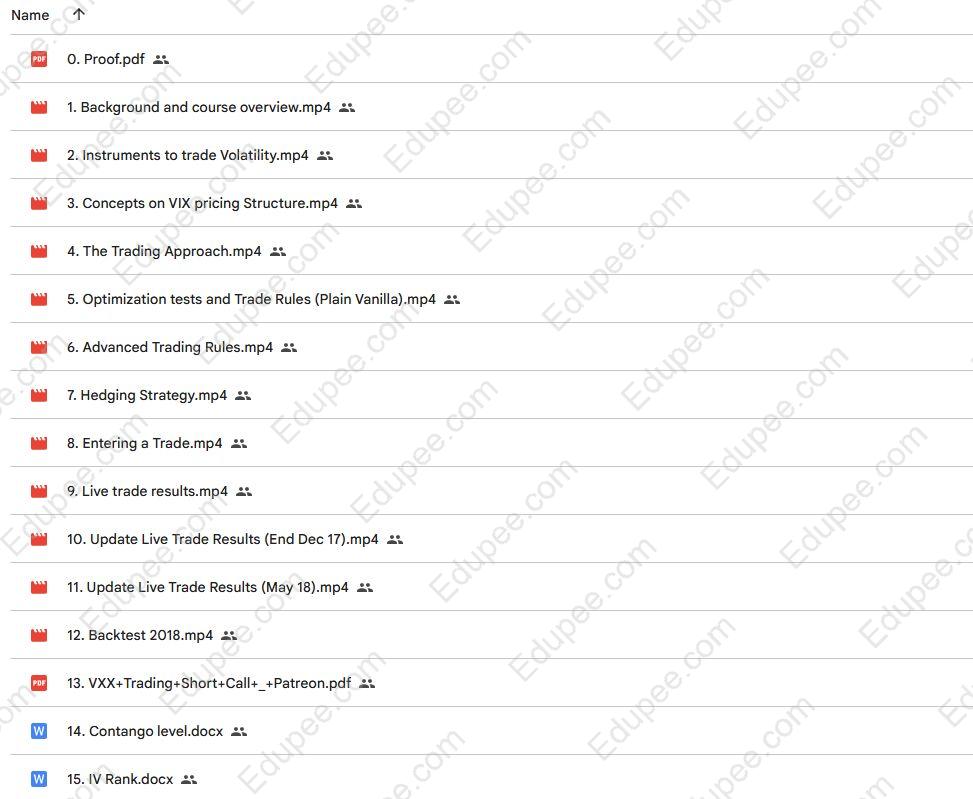

Content Proof:

Stock Options Strategy: VXX Short Vertical (mid/high risk)

Discover a straightforward, highly profitable weekly income strategy using VXX options, combined with a built-in hedging approach. This trade is applied only under specific market conditions, which are clearly outlined in the course.

This program presents a proven options strategy grounded in statistical analysis and validated through long-term results. It’s one of my core trading methods because of its consistent profitability and ability to generate steady income, working as a strong complement to the CROC Trade. Having left behind stock trading, stock options, and forex years ago, I now focus exclusively on volatility trading — my area of expertise.

Inside the course, you’ll learn an easy-to-apply options strategy (entry-level, no adjustments required) that delivers weekly growth and consistent income. Built on the unique price behavior of the VXX volatility ETN, this method leverages its predictability to gain a clear market edge and significantly enhance your portfolio performance.

We’ll start with the fundamentals of volatility analysis, then move step by step into building the strategy — explaining the rationale, demonstrating its edge, and optimizing it for stronger performance. You’ll finish with a complete, rule-based trading plan that’s simple to execute, designed for controlled risk, and supported by extensive backtests that confirm its consistency and robustness.

All you need is basic options knowledge and access to a brokerage account (live or paper trading if you prefer to practice first). The strategy can also be applied within IRA accounts.

Free Download: video Sample from Stock Options Strategy: VXX Short Vertical (mid/high risk)

Course content:

My Background / Experience

Price Action: VIX® Index vs Stock

Why Volatility investing is much more interesting

Volatility trading risks (and how to control them)

Instruments of Volatility Trading

VIX® futures Term Structure

Contango, Backwardation and Roll Yield

The Trading approach

Strategy statistical Edge and optimization

Options Trading Rules (The Plain Vanilla / Mechanical)

Advanced Options Strategy Rules (extra profitability on discretionary approach)

Hedging Strategy with VIX options

Results obtained

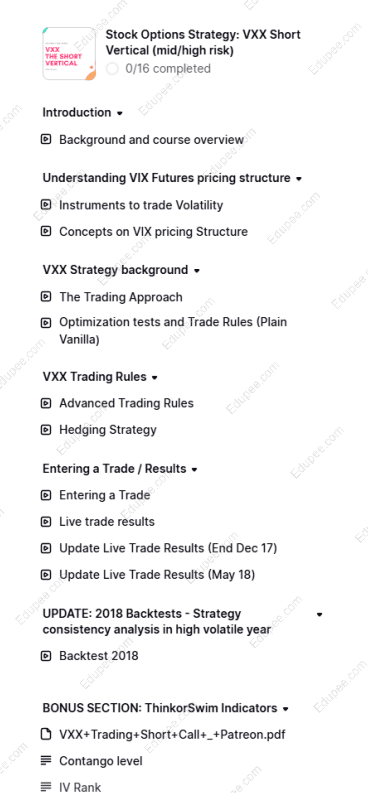

Contents

Introduction

- Background and course overview

Understanding VIX Futures pricing structure

- Instruments to trade Volatility

- Concepts on VIX pricing Structure

VXX Strategy background

- The Trading Approach

- Optimization tests and Trade Rules (Plain Vanilla)

VXX Trading Rules

- Advanced Trading Rules

- Hedging Strategy

Entering a Trade / Results

- Entering a Trade

- Live trade results

- Update Live Trade Results (End Dec 17)

- Update Live Trade Results (May 18)

UPDATE: 2018 Backtests – Strategy consistency analysis in high volatile year

- Backtest 2018

BONUS SECTION: ThinkorSwim Indicators

- VXX+Trading+Short+Call+_+Patreon.pdf2.16 MB

- Contango level

- IV Rank

Reviews

There are no reviews yet.